Monthly payment on 50000 heloc

Home loan like a cash-out refinance of your first mortgage youd start paying the interest and payments on 50000 as of day one. Want a stable monthly payment for the life of the loan.

Refinancing For Home Improvements Should You Do It

Cash-out refinance option 3.

. When you get a HELOC through Prosper your mortgage and HELOC combined can be worth as much as 90 of your homes fair market value. With a Bank of America HELOC there are no closing costs no application fees no annual fees and no fees to use the funds. Lets say you owe 50000 with a 6 interest rate and a 10-year repayment term.

Consider doing so though after the Covid-19 monthly payment freeze has ended. If youre looking to borrow against your home equity but want a fixed interest rate and a fixed monthly payment consider a home equity loan. DTI ratios measure your gross monthly income relative to your monthly debt will also help drive your HELOC rate down.

Leaving you with the maximum home equity line of credit you could receive as 50000. 60-day rate lock 4. The home loan calculator accounts for mortgage rates loan term down payment more.

With a Bank of America HELOC there are no closing costs no application fees no annual fees and no fees to use the funds. The less monthly debt you have compared to your income the better. For example lets say you have saved 50000 for your down payment.

Heres how it works. 50000 200000 - 150000. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out at closing and change your loan term to 5 10 15 or 20 years.

You have a first-mortgage balance of 190000 and a HELOC balance of 50000. Although its a myth that a 20 down payment is required to obtain a loan keep in mind that the higher your down payment the lower your monthly payment. Some loans like VA loans and some USDA loans allow zero down.

If your home is worth 100000 and you owe 40000 on your mortgage then your CLTV is 40. Say your total monthly debt payments for a mortgage plus a car loan equals 1500 and your gross monthly income is 5000. A 20 down payment also allows you to avoid paying private mortgage insurance on your loan.

This steep rise in the monthly HELOC payment can be a shock to borrowers who were making interest-only payments for the first 10 or 15 years. A HELOC is a revolving line of credit based on the equity in your home. If you divide 240000 by 300000 you get a CLTV.

Viewing Your Results Once you have filled out all your information click on the calculate button to see the side-by-side results for your old loan and the loan with extra payments made. With a HELOC you would use 25000 for the kitchen and wouldnt add. 1 Other fees may apply such as discount points to buy down your rate.

Once the 5 7 or 10-year term of your loan has expired you may be required to make a balloon payment to pay off the entire loan balance or the HELOC can become a traditional 10 15 or 20-year. 2 For eligible fixed rate ARM and VA loans PenFed offers a lender credit to all members who submit a completed home purchase mortgage application on or after March 1 2020. Include the rate of interest any additional equity you would like to withdraw as a cash payment the closing costs associated with the loan and the length of the loan term.

The monthly payment reflects both the repayment for the cash out at closing and your monthly mortgage payment. If you wont be in your home long-term and want a lower monthly payment this loan could be for you. Our mortgage calculator helps you estimate your monthly mortgage payments.

The minimum credit line amount is 50000 or the minimum amount permitted by state law whichever is less. This makes a total of 240000 already borrowed against your home. Upwards of 30 -45 days.

Up to 100 CLTV financing when combined with UNIFYs Down Payment Second Mortgage Helper 1. While a HELOC offers the most favorable terms typically they take the longest for approval. While HELOC line amounts range from 50000 to.

Examples of variable loans include adjustable-rate mortgages home equity lines of credit HELOC and some personal and student loans. When you do use it youll start getting a monthly statement and the payment will be calculated on the outstanding balance. Down Payment Amount - 25000 10 500000 Maximum Affordability.

For example on a 50000 HELOC with a 5 interest rate the payment during the draw period is 208. For automatic monthly payments. The maximum home price you could afford would be.

You could add 360 extra one-type payments or you could do an extra monthly payment of 50 for 25 years and then an extra monthly payment of 100 for 3 years etc. A HELOC home equity loan will give you the most favorable monthly payment terms due to the length of the loan available. CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value.

The Payment Calculator can determine the monthly payment amount or loan term for a fixed interest loan. Insights from Freedom Mortgage. That means your.

Compare Free Loan Offers. Because you withdraw funds as you need them with a HELOC the repayment process requires interest-only monthly payments on the amount of money borrowed. For example if youre extended 50000 and use.

5 Maximum Affordability. Many lenders require a degree in order to refinance so its. When is the best time to refinance student loans.

Whereas during the repayment period the monthly payment can jump to 330 if it is over 20. Your monthly payment is 555. If you refinance to a 4 interest rate and a seven-year term.

If HELOC or HE Loan. It is important to understand that the payment during the repayment period can be significantly higher than the draw period. 200000 Value of home x85 170000-120000 Mortgage balance.

The results will compare your new home equity loan payments to the monthly cost of the old debts the effective interest rate and the total monthly payment on those debts. The maximum credit line is 1000000. Learn about the current requirements for a HELOC including home equity value credit score debt-to-income ratio and more.

200000 Value of home x85 170000-120000 Mortgage balance. Additional terms and conditions apply. Leaving you with the maximum home equity line of credit you could receive as 50000.

Use the Fixed Term tab to calculate the monthly payment of a fixed-term loan. For more information. The amount you qualify for is based upon the amount of equity available in your home.

For automatic monthly payments. Annual lifetime interest rate caps. After the interest-only draw period ends a balloon payment may be due making the HELOC.

For loans 0-199999 the. Members can receive the lender credit upon closing with PenFed subject to qualification and approval. 50000 to 2500000 loan amounts 2.

If your down payment is 25001 or more you can find your maximum purchase price using this formula.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Looking For A Heloc Calculator

Credit Score Requirements For Heloc

Home Construction Loan Calculator Casaplorer

Home Equity Line Of Credit Calculator Addition Financial

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

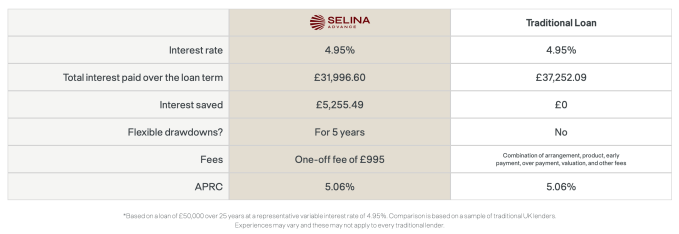

Selina Raises 150m To Dish Out Flexible Loans That Leverage Home Equity Techcrunch

Looking For A Heloc Calculator

Looking For A Heloc Calculator

Home Equity Loans Heloan Regions

How Much You Can Borrow For A Home Improvement Loan Banks Com

Federal Register Mortgage Servicing Rules Under The Truth In Lending Act Regulation Z

Looking For A Heloc Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Home Equity Loans Heloan Regions

Should I Open A Heloc